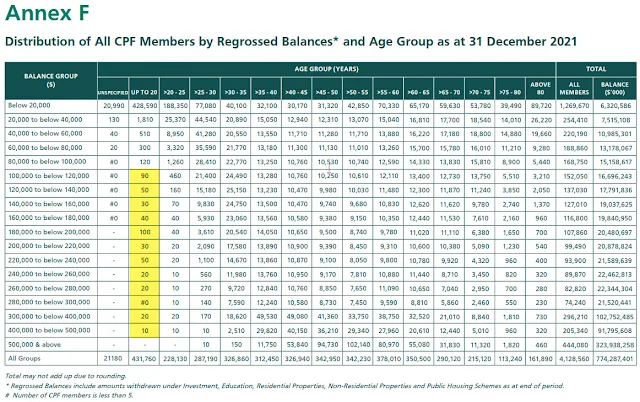

From the recently

released 2021 CPF annual report, it seems like we have quite a number of people

under 20 years old having lots of money in their CPF. There's 10 of them with $400k to $500k!!! More than a 40 years old me... Looks like there are many

people topping up their kids or grandkids CPF to help them grow their money. I

think it’s a good way to start the power of compounding young at a relatively

risk free rate of 2.5 to 4%...… but I will most likely not do it for my kids.

|

Don't get me wrong, I like the CPF system. I think the 4% relatively risk free rate the Special Account is giving is hard to beat. I also believe that the CPF is a good financial safety net to build in your financial journey. So why am I not giving my kids a head start by helping them top up their CPF?

First and foremost, I

need to build up my own financial security and retirement plan first. Before I

even consider topping up the kids CPF or even leaving any kind of legacy for

them, I want to make sure my wife and my financial affair are settled. I

believe the best legacy we can leave for the kids is not needing them to worry

about paying for our allowance, medical bills etc.… as we age. Being the

sandwich generation where I have to support my parents and my kids, I definitely

feel the crunch financially.

Because my parents are

not very financially savvy and don't have a good retirement income, we are giving

them monthly allowance to support them. We are also helping them pay for their

outstanding housing loan and medical bills. Fortunately, I have 2 siblings to

share this load with. I have also made use of my mum's CPF account to help

lessen this load and you can read more about that here. Despite all that, a good portion of my monthly expenses still

goes to my parents.

As far as possible, we

hope to be able to build up our wealth and have a retirement plan so that we can

pay for all of our expenses including housing loans, health insurance etc. when

we retire. This will help to reduce the financial burden our kids have in

needing to support us. Of course we wouldn't mind if they are well to do enough

to give us some allowance but it wouldn't be something they need to be stressed

about.

Second and most

importantly, I think it is better for our kids to learn how to build up their

own CPF. As the sayings goes "give a man a fish, you feed him for a day, teach

a man to fish, you feed him for a lifetime". Instead of topping up their

CPF for them, I would rather educated them about the power of compounding and how

CPF is a good option for them to use as a powerful compounding tool. Then if

they choose to use their savings from their Ang Bao to top up their CPF, we

will be more than glad to help them with that. We might even consider matching

their contribution just to nudge them along.

Having been through the

journey of building up my own CPF account (which you can read more about here), I can say that it definitely helped me appreciate more on the

power of compounding. The decisions I have taken and the choices I have made to

build up this financial safety net and seeing the results of those choices and

decisions slowly producing results definitely helped me grow and become more financially

savvy. As much as I would like to have a huge sum of money in my CPF before I turn

20, I feel that the journey of learning and building up my CPF is more

rewarding and I wouldn't want to take away such valuable learning opportunities

from my kids.

Reviewed by Valuewarrior

on

July 15, 2022

Rating:

Reviewed by Valuewarrior

on

July 15, 2022

Rating:

Actually over 20 years, you'll get much better returns in a S&P etf or Msci World etf.

ReplyDeleteBut the problem like you said is that the children won't feel anything & won't realise the hard work.

Worse, they'll be tempted to simply spend as it's not trapped inside cpf lol.

I don't think due to topping up . likely their parent away early and the cpf transfer to their kids. pls check face.

ReplyDeleteRead: Top up CPF Medisave for kids. The benefits will astound you and might convince you otherwise

ReplyDelete