If you’ve recently topped up your loved one’s CPF Retirement Account (RA) and are wondering where the money went, you’re not alone.

Understanding how CPF works, especially the CPF LIFE Plan, can help you make the most of your contributions.

Here’s a breakdown of what happened to the $10,000 I topped up

to my mum’s CPF account and how it impacts her retirement payouts.

Similar to the past few years, this year, I have decided

to top up my mum’s CPF Retirement Account, this time with a total of $10,000.

Here’s why:

- Tax Relief:

$8,000 was topped up to maximize tax relief for myself as the donor.

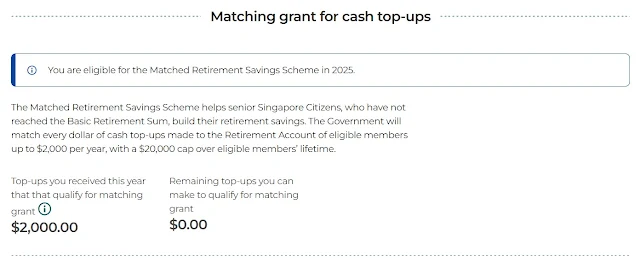

- Matched Retirement Savings Scheme (MRSS): $2,000 was topped up to take advantage of the MRSS,

which will be matched by the government.

Starting in 2025, the MRSS matching cap will increase from $600 to $2,000 annually, with a lifetime limit of $20,000. Additionally, the age cap of 70 years old has been removed, making it a great opportunity to boost retirement savings for older family members.

Log in to your loved one's CPF to make sure they are eligible and your top up also qualify for the MRSS.

Here’s a step-by-step

breakdown of what happened to the $10,000 allocated in my mum’s CPF Retirement Account:

- Initial Top-Up:

- The full $10,000 was credited to her Retirement Account (RA) within a day of the top-up via PayNow.

- CPF LIFE Premium Deduction:

- My mum is on the CPF LIFE Basic Plan, which deducts approximately 20% of the RA balance to pay for the CPF LIFE premium.

- In this case, approximately $2,400 was withdrawn from her RA for the CPF LIFE premium.

- If she were on the CPF LIFE Standard or Escalating Plan, 100% of the RA balance would have been used for the premium, leaving no remaining balance in her RA.

- Increased Monthly Payouts:

- The top up increased her monthly payout from approximately $590 to $650.

- CPF LIFE Premium

- It is interesting to note that, for CPF LIFE Basic plan, CPF LIFE will only start the payout after the RA had been depleted when you are around 90 years old. Before that, the CPF LIFE premium is not being deducted and forms part of your legacy.

How to Track Your CPF Top-Ups and Payouts

You can easily monitor

all transactions and changes in your loved one’s CPF account:

- Log in to their CPF account and navigate to the Retirement and Transaction history section.

Reviewed by Valuewarrior

on

February 17, 2025

Rating:

Reviewed by Valuewarrior

on

February 17, 2025

Rating:

No comments: