Bitcoin has seen a crazy surge in 2020 that follows through to the first week of 2021. It moved from around USD$7000 in Jan 2020 to USD$41,000 in early Jan 2021 smashing previous all-time high of USD$20,000. That’s around a 6 X increase in just a year.

One

of the reasons why people are buying into Bitcoin in 2020 is that Covid-19

resulted in many government around the world printing money and lowering interest

rate to support the economy. This devalues fiat currencies causing many to take

flight to save haven assets such as Gold and more recently Bitcoin.

Many believes that Bitcoin is the "Digital Gold" because it shares many similarity with gold such as: they are both limited in supply, costly to mine and also impossible to counterfeit. In fact, many think that Bitcoin is actually way better than gold. Some of the advantages of Bitcoin over gold that are often brought up by proponents are,

- Bitcoin only has a fixed supply of 21 Million while gold supply can increase especially if it's price increase incentivizes more gold mining in more exotic locations.

- Bitcoin is way simpler and cheaper to store than gold.

- Bitcoin is easier to be used for transaction compared with gold.

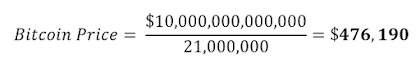

Because

of this "digital gold" status many predicted the value of Bitcoin to

be around a whopping USD$400,000. This is based on the fact that gold has a

market cap of around USD$10 trillion now and there is only a fix supply of 21

Million Bitcoin. Some simple math and you get the value of bitcoin.

So is

Bitcoin really the "Digital Gold" and worth USD$400,000? Let's take a

closer look to see if Bitcoin is really better than gold before you all go FOMO

and go on a buying spree.

- Yes, bitcoin does have a fixed supply of 21 Million. But Bitcoin can hard fork to other crypto currencies. Bitcoin cash, Bitcoin gold and Bitcoin Diamond are examples that have hard forked from Bitcoin in the last few years. A hard fork is a radical change to the protocol of a blockchain network that makes previously valid blocks/transactions invalid and a new chain needs to form alongside the old one. Usually a hard fork happens to add new functionalities to the old block chain. So far the various Bitcoin forks have not overtook Bitcoin in terms of market capitalization but they have definitely took some shares of it. However, this can possibly change if a much better version of Bitcoin comes up in the future. With how fast the block chain technology is evolving, I wouldn't be surprised if that happens.

- Bitcoin is definitely much simpler and cheaper to store and secure than gold. You only need a "digital wallet" to store and a Private Key to secure your Bitcoin. However, simple doesn't mean easy. For "digital wallet", we have hot and cold wallet, the cold one being more secure. It takes quite a bit of reading to figure out what is what and how to securely store your Bitcoin yourself. Also, you will need your private key if you want to access your Bitcoin. If you lose it, it will be locked with no way to access it! There are no forgot/reset password and there will be no one that can help you unlock your wallet. In fact, there are quite a lot of Bitcoin being locked out of circulation because people forgot or lost their private key. That's how secure Bitcoin is…. So secure that it can even keep you out! So yes, it may be simple and cheap to store and secure Bitcoin, but if you don’t do it properly, the consequences can be way costly.

- Bitcoin is easier to use for transaction because it is easily divisible down to 0.00000001 Bitcoin or 1 satoshi, the smallest unit of Bitcoin. Essentially you can use Bitcoin to buy a bowl of Bak Chor Mee and also use it to buy a house easily. On the other hand, you can't really practically divide your gold bar or gold coin to pay for your lunch. However, because of the volatility of the price Bitcoin, it might not be so practical to use Bitcoin as a currency. You don't want to find out that your bowl of Bak Chor Mee cost a 5 times more a month later because Bitcoin price increased by 5 X. Just like gold being seen more as a store of value rather than currency ever since the gold standard was abandoned in 1971, Bitcoin is more for store of value rather than a currency. Hence, it doesn't really matter if it's easier to transact with bitcoin since this will not be its main use case.

To conclude, Bitcoin being the "Digital Gold" or better than gold is indeed a very appealing proposition that is getting huge support. However, on a closer look, things may not be as simple and to equate it to gold and give it a value of USD$400,000, in my opinion, is just risky speculation. So what do you think? Do share it in the comment below.

Do support me at my Referral and Store Pages. Appreciate your support and Happy Cryptoing!

Reviewed by Valuewarrior

on

January 16, 2021

Rating:

Reviewed by Valuewarrior

on

January 16, 2021

Rating:

No comments: