Following up on my previous post on 'Helping your parents maximize their CPF account', I had gotten permission from my mom and have decided to share how my Mom's CPF account grows over the year as it was being faithfully topped up and earned interests throughout the years.

Her account started with about $3400 in her RA and $3200 in her OA and was only earning about $370 in interest. This was at the end of 2016.

After transferring all her OA to RA and topping up $7000 to her

RA for tax relief, her RA reached about $14,000 and is getting close to $680 in

interest in 2017.

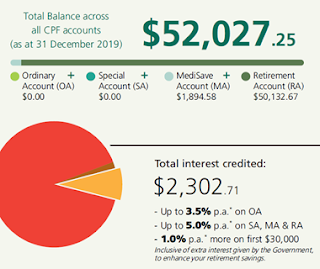

2019 was the year

where on top of the $7000 top up for tax relief, I started to transfer my OA to

her RA to quickly hit $60,000 for the 5% and 6% interest in RA. her RA grows to

$50,000 and is earning about $2300 in 2019.

This year, 2020, her Retirement account had already surpassed $60,000 and is going to earn an estimated amount of more than $3000 interest at the end of this year.

I have to say that this journey was not an easy one. Since

the top up and transfer is a one-way street, there are plenty of considerations

and calculations before committing to the $7000 cash top up and subsequently OA

to RA transfer. However, looking back, I have to say that it feels great to see

how her Retirement Account had grown throughout the years and how much "Ah Gong" had contributed and will be contributing to part of it.

She is turning 70 soon. This amount of money in her RA will be

slowly paid out as part of Retirement Sum Scheme to supplement part of her monthly

allowance making all these effort worthwhile.

Happy CPFing!

Reviewed by Valuewarrior

on

September 19, 2020

Rating:

Reviewed by Valuewarrior

on

September 19, 2020

Rating:

Thanks for writing your experience and I like to read about others who have done the same! I did the same thing for my mum and transferred my OA to her RA!

ReplyDeleteKevin

It's depened all in individual,provided you got a fund to transfer to your love one,

ReplyDeleteYoure trully right..importantly dont hold our account more than you should..$90.500 in retirement yet you dont release the balance i had..want me go begging for what.why must i buy hse if i have place to stay. why must i get help from charity give the balance cos i want to give to my childrens while waiting 65 .i died still they have the 90.500..hello cpf

Delete