With the recent inflation data from US, I think the economy

is about to get worse before it gets better.

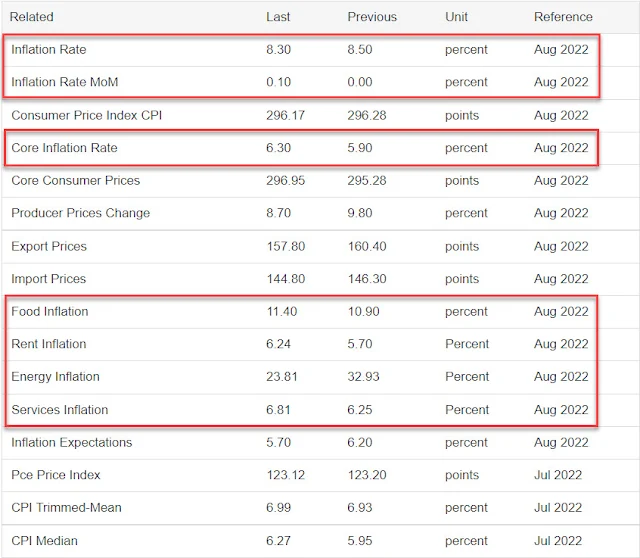

From the data, US inflation eased for a second straight month from 8.5% to 8.3% year on year.

This is good since inflation seems to be slowing down. However, looking closer, the month on month inflation actually increased by 0.1%.

This is not a really significant increase but considering the huge drop in energy prices past months, any increase in inflation month on month is really not expected.

This is most likely why the market reacted quite negatively towards it.

Also if we look at the core inflation rate, which excludes volatile energy and food prices, it increased by 6.3% year on year, the most since March 2022.

With winter coming up in the states, energy price is expected to rise again. What do you think will happen to the US inflation rate coming 4th quarter?

Looking at all of these, I believe the US Fed will likely be more aggressive in taming inflation in the coming 4th quarter. This will most likely have a negative impact to the economy and possibly the stock market as well.

So what am I doing in such circumstances?

I have written a post on

how to combat high inflation previously and I think most of the points are applicable here as

well. So do go there to have a read.

Also I think that there

is a good chance that the stock market will go lower presenting good buying opportunities.

Disclaimer: I could be very wrong

here as the stock market has the habit of doing whatever it wants.

Regardless, I'm

conserving as much cash as I can and slowing nibbling into the market when I see

a good drop of 3% to 5%. Hopefully this pays off in the long run.

Get your free $10 NTUC vouchers and more with Trust Bank here.

Check out the CPFcalculator to plan for your retirement now!

As always, thanks for reading and do support me on my referral page. Stay Safe and Happy investing!

Reviewed by Valuewarrior

on

September 17, 2022

Rating:

Reviewed by Valuewarrior

on

September 17, 2022

Rating:

No comments: